The United Kingdom, Kuwait, Canada, United States, Colombia top energy intelligence firm Rystad's list of countries that offer the best fiscal conditions for the development of large offshore oil fields.

After what has been described as a disappointing year for offshore sanctioning, Rystad expects offshore sanctioning to rebound to at least $56 billion in 2021 and keep rising to as high as $131 billion in 2023.

"Operators are now even more focused on costs and profit margins, and majors are expected to concentrate their individual activity to fewer countries than before. This means the world’s resource-rich countries will have to compete more than ever to attract investments," Rystad said this week.

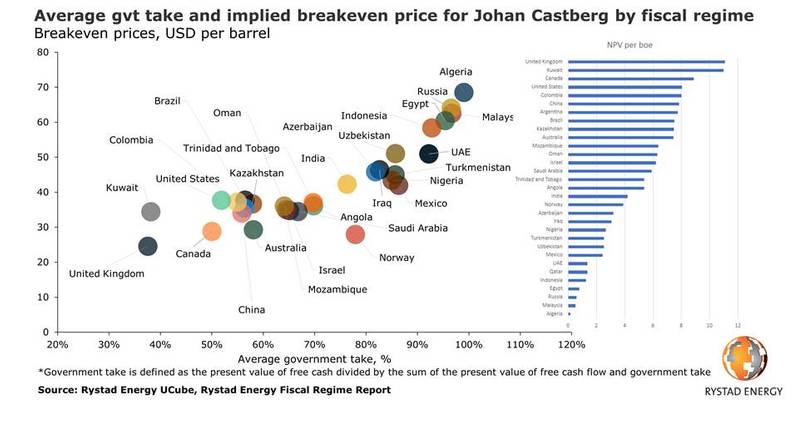

Rystad Energy has analyzed how each country’s fiscal regime affects the profitability and breakeven price of developing offshore mega-projects across the world. This has resulted in a top five list of countries for profitable large-scale field developments, seen from the operators’ perspective.

"For the purpose of modeling each country’s score, we have used a sample project with the characteristics of Norway’s Johan Castberg field, a single-phase project with plenty of available data that makes it an ideal candidate for benchmarking. To get a fair comparison the analysis does not take into account the activity of national oil companies (NOCs) in their home countries," the company explained.

In Rystad Energy’s analysis, the United Kingdom scored the highest post-tax valuation and offers the best profitability conditions for operators, with a net present value (NPV) of $11.1 per barrel of oil equivalent (boe) in the country at a flat oil price of $70 per barrel. The next in line are Kuwait ($11 per boe), Canada ($8.9 per boe), the US ($8 per boe) and Colombia ($8 per boe).

In Norway itself, a non-NOC company would, per Rystad, only enjoy an NPV of $3.9 per boe from the Johan Castberg project. That said, other parameters factor in for operators, as Norway is a country where the risk of exploration is lower as the country shoulders some of the cost for unsuccessful wells.

“The world’s average government take has declined in recent years and we expect that it will further drop going forward as oil and gas producing countries strive to attract foreign investors in a very competitive environment. Fiscal regimes that have higher government take will struggle to compete,“ says Espen Erlingsen, Head of Upstream Research at Rystad Energy.

For each of Rystad's analysis’ simulations, gross resources, production, prices, investments and operational costs were kept constant. The differences were in the fiscal parameters of the different fiscal regimes. The calculation of the key metrics was carried out from the approval year, which is 2018. Since there are varied fiscal regimes within the countries in the benchmarking exercise, we have selected the fiscal regime that we think best represents the country.

Per Rystad, for Johan Castberg, the breakeven price ranges from around $25 per barrel (bbl) to around $65 per bbl under the different regimes.

"Some of the key mechanisms that drive up breakeven prices are high gross taxes (like royalty or export tax) or tough cost recovery methods (such as cost ceilings and deprecation spread over many years)," Rystad said.

When it comes to breakeven prices of the project, the lowest ones are in the United Kingdom and Norway. Both countries benefit from only having net taxes (tax on profit) and an easy cost recovery system. Countries such as Indonesia, Malaysia, Egypt, Russia and Algeria are all countries with a high gross tax or tough cost recovery methods.

No comments

Post a Comment