As the old saying goes, one man’s misery is another man’s fortune. This could not be a more accurate statement reflecting the current offshore mobile offshore drilling unit (MODU) market. As MODU owners battle debts, restructuring and bankruptcy (see previous article MODU Owners Bite the Bullet), cash buyers have taken advantage of owners trimming the proverbial fat to survive the downturn and COVID-19 market.

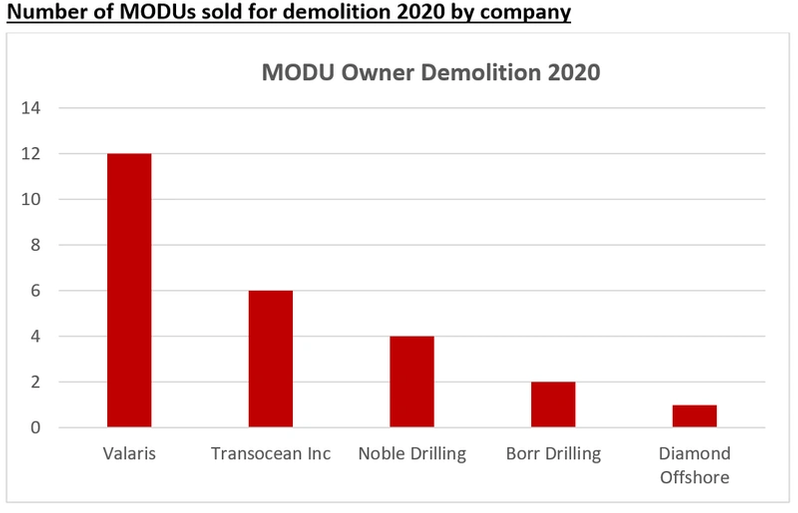

The above graph outlines the top five major MODU owners offloading tonnage for demolition during 2020. As expected, the large public companies have been the most active. In 2020 Valaris removed a substantial number of non-core assets from its fleet. Compare this to 2019 when they scrapped only five MODUs.

What’s in the market?

Cash buyers interested in MODUs are spoiled for choice currently, Saipem recently announced they would be scrapping the following rigs all based in UAE.

- Jack up Perro Negro 5 245 ft blt 1981 Levingston

- Jack up Perro Nego 2 300 ft blt 1980 Marathon Shipbuilding

- Semi-Submersible Scarabeo 7 4,920 ft blt 1980 Gotaverken Finnboda

Also up for sale is the Aban Offshore rig fleet. Earlier this year a deal was finalized for the vintage units. However, the deal never materialized due COVID-19, and the fleet is once again for sale. The exact vessels to be auctioned are not yet known, but we expect several demolition candidates from the sale.

Seadrill looks like it may enter Chapter 11 (for a second time), and the company will likely be reviewing its fleet and scrapping nonperforming, laid-up assets. Utilizing VesselsValue recency of AIS tool we can determine any MODUs in the Seadrill fleet that have not signaled for over eight weeks, and we can ultimately define these as potential scrapping candidates.

| Rig Name | Type | Size | Built | Beneficial Owner |

|---|---|---|---|---|

| West Alpha | Semi-sub | 2,000ft | 1986 (NKK) | Seadrill Mgmt |

| West Sirius | Semi-sub | 10,000ft | 2008 (Jurong) | Seadrill Partners |

| West Vigilant | Jack-up | 350ft, 7,156gt | 2008 (Keppel AmFELS) | Seadrill Mgmt |

| West Eminence | Semi-sub | 7,874ft, 25,300dwt | 2009 (Samsung) | Seadrill Mgmt |

| West Freedom | Jack-up | 350ft, 7,410gt | 2009 (Lamprell) | Seadrill Mgmt |

| West Leda | Jack-up | 375ft 9,985gt | 2010 (PPL) | Seadril Mgmt |

| West Orion | Semi-sub | 7,874ft, 7,000dwt | 2010 (Jurong) | Seadrill Mgmt |

| West Eclipse | Semi-sub | 10,000ft, 33,000dwt | 2011 (Jurong) | Seadrill Mgmt |

| West Leo | Semi-sub | 10,000ft, 14,500dwt | 2012 (Jurong) | Seadrill Partners |

Seadrill MODU AIS greater than 8 weeks

Also, rumor has it from Seadrill associated company Sevan Drilling that the monster semi-sub Sevan Driller 10,000 ft blt 2009 Nantong COSCO has been sold for demolition.

So even from just these three owners we could expect around 15 + more MODUs scrapped during 2020 and into 2021.

Younger models hit the beach

An interesting development in the MODU demolition market is the age of asset heading the breakers yards. The table below shows in 2020 there was an increase in the number of 15 years old or younger rigs being sold. This decrease is rig life has opened lots of potential new tonnage candidates for cash buyers.

| Year | MODUs 15 Years or Younger Sold for Demolition |

| 2020 | 9 |

| 2019 | 1 |

| 2018 | 0 |

| 2017 | 0 |

| 2016 | 2 |

| 2015 | 0 |

Among MODUs sold for demolition in 2020 under 15 years old are:

Drillship Noble Bully 1 and Noble Bully 2, 8,200ft, 2011, Chengxi Shipbuilding sold for demolition for undisclosed price. Noble Bully 1 was located Curaco and Noble Bully 2 Oman

Drillship Valaris DS 3/5/6 10,000 ft, blt 2010/11/12, Samsung sold for $180 per ldt. This equates to around $6.5 million per unit. These were purchased by a Turkish demolition buyer

Semi-Submersible Valaris 8500/1/2, 8,500ft, blt 2008, Keppel FELS sold for $143 per ldt. This equates to around $2.7 million per unit. Although the buyer is not yet known, it is assumed a U.S. demolition buyer, or further trader.

Potential low hanging fruit

As mentioned earlier, utilizing VesselsValue recency of AIS tool we can determine any MODU that has not signaled for greater than eight weeks, and we can ultimately define these as potential scrapping candidates. These are outlined in the table below.

| MODU Type | # With AIS Signal Greater Than 8 Weeks |

| Drillship | 12 |

| Semi-sub | 27 |

| Jackup | 81 |

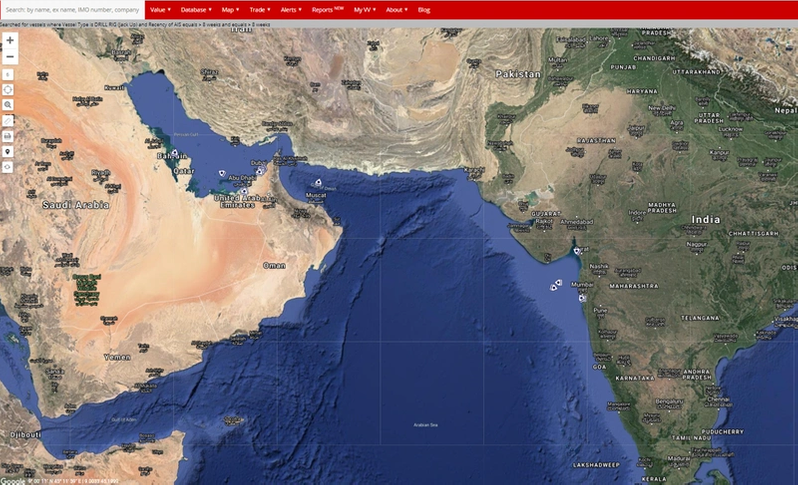

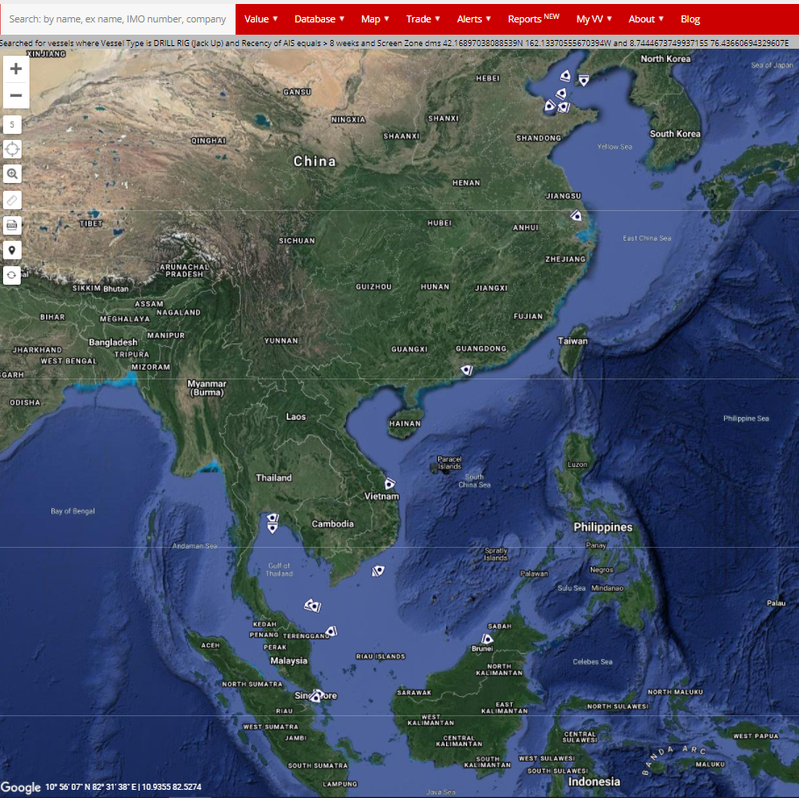

Of particular interest to cash buyers will be the number of Jack up rigs deemed demolition candidates (based on AIS). A large proportion of these are based in Southeast Asia, Middle East and India, all well placed for delivery to the sub-continent and making them an attractive investment.

Jackup rigs located in the Middle East and Inia (Recency of AIS greater than eight weeks)

Jackup rigs located in the Middle East and Inia (Recency of AIS greater than eight weeks)

Jackup rigs located in Southeast Asia (Recency of AIS greater than eight weeks)

Jackup rigs located in Southeast Asia (Recency of AIS greater than eight weeks)

No comments

Post a Comment